Don't settle for half the story

Demyst gives you access to all of the data you need. Evaluate thousands of data attributes from hundreds of possible data connectors all pulled into your own custom-built APIs for instant data deployment.

COVID-19 cases have been found in 198 countries and territories around the world. 198 out of a total of 251. The disease is truly global in nature and is impacting almost every single aspect of the circular flow of the economy that we learn about in high school (consumption, investment, government spending, imports and exports).

To support the economy, an injection of expenditure is required. Banks and business lenders play an important part by providing finance to businesses. However, for their own health, they must do this both prudently and quickly.

To act at the speed required, lenders need information and lots of it. Financial statements, cash position and historical health are important but lenders must consider additional stressors on a business both from its consumers as well as its suppliers. This is where external data can help.

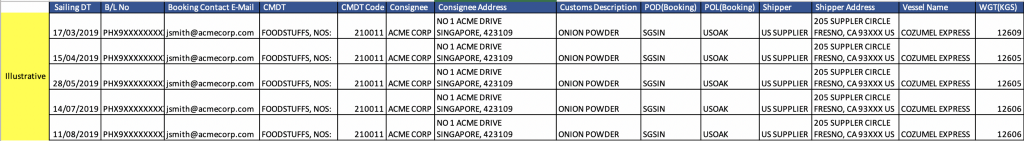

Take the example of a food manufacturer that sells snack food products in supermarkets and specialty food outlets. The company is based in Singapore where consumer movements are not as restricted at the time of this writing as they are in some parts of the world. So there is demand for products, even if it is lower. The snack food products that the company makes use onion powder imported from the United States at a frequency of one shipment every 2 months. The US supplier is based in California where the state government issued an executive order to shelter in place (1). This means the supply of the ingredient is halted until further notice from the government. The manufacturer now faces the following risks:

Having access to this supply chain lens through import-export data coupled with financials, firmographics and other risk indicators allows lenders to holistically assess the snack food manufacturer’s risks and understand their business to find the best way to serve their needs. Maybe they need ongoing support rather than a one time injection of funds. Maybe they need a combination of products, maybe the lender can connect the business to alternate suppliers through its networks.

This is one example where It is critical that lenders get access to any information that can help build a fuller view of the business’s need. Ultimately financing solutions built this way could be the difference between a business surviving only to fail later and a business surviving and thriving. In a COVID-19 impacted world, where every business matters, a lender that focuses on the latter outcome can have an outsized impact on helping the global economy.

Don't settle for half the story

Demyst gives you access to all of the data you need. Evaluate thousands of data attributes from hundreds of possible data connectors all pulled into your own custom-built APIs for instant data deployment.

External data can be easy to discover and deploy